It’s hard to believe its anything other than the PM being terrified of getting the same treatment Shorten got at the 2019 election.

The decreasing supply of votes, you say…

it will “decrease the supply” of money that developers are receiving is what he meant. And through that, “decrease the supply” of money being gained by the government when house prices drop. It will then “decrease the supply” of votes that the government will get at the next election.

I think they’re going to do make some changes. They won’t be as much as the Greens want, but they’ll be enough that the Greens can’t vote no. By having distance between themselves and the Greens they insure themselves against claims that they’re hostage to the minor party, but the changes have to be enough to, y’know, do something.

The opposition might be somewhat split on this too - people like Andrew Bragg have floated reform in this space and younger voters want to see it.

Given we keep getting told there’s a labour constraint with big gov infrastructure projects taking all the workers, and a materials shortage due to global supply issues that are finally starting to resolve, it seems unlikely that sales demand is the limiting factor in building commencements.

NSW Labor pretty much put all infrastructure prijects on hold when they got in. Still not fully recovered…

Shared with the caveat that correlation doesn’t imply causation, other influences happened around the same time like the mining export boom, etc:

On the dangers of correlation

Some economists need to be treated like arts grads. Its about the same level of critical thinking applied…

Oi!

I think that chart does kinda prove the point though… while everyone enjoyed the “end of history” period of cheap global finance up until the 2007 crash in the US, the only country where prices have gone higher than ours has a CGT that works basically the same as ours… and they reduced the CGT discount for gains over $250k in June.

At the risk of this becoming the “real estate/ housing affordability thread”: I think there’s a couple of things I can’t get past.

-

there seems to be a lot of conflation between housing affordability and home ownership affordability. I think everyone agrees that having a roof over your head is a human right. There is less agreement that actually owning that roof is a right that needs to be protected.

-

increasing the number of roofs over people’s heads is going to take investment. By property investors. Or by that government directly. Probably both. So I cant see how minimising property investment (ie this idea that housing shouldn’t be treated as a commodity, all property investment is bad etc etc) is productive. Surely we just want the government to direct that investment into the areas where it will generate more heads with roofs over them?

All the benefits we see that the Howard government bestowed that turned housing from home to investment should only have ever been available for new builds.

And not new builds you buy from the developer.

But new builds that you break the ground on.

You’ve already distanced yourself from the “1999 inflection point” narrative from the Greens instagram post. It’s pretty hard to claim NG/CGT is the primary driver when it did little for the 8 “end of history” years (and indeed Canada with CGT discounts lagged for much of that period), prices went sideways for 5 years, then NG/CGT drove the 2010s ZIRP-era boom. NG/CGT may be why Aus/Can didn’t see prices drop during the GFC like the US/Ireland (or was it their terrible lending practices, or the mining boom). You can clearly see big global events driving inflection points in Ben Phillips chart.

The Aus institute recently posted research estimating the NG/CGT impact at about 4%, Grattan had previously modelled more modest changes at 1%. I think these could both be underplaying the impact of narrative and confidence in drawing non-rational “mum and dad” investors into NG even when other investments may suit them better. Regardless, reforming NG/CGT would bring us down to a UK/France type path, still mostly global macro driven, not immediately affordable housing. Reforms will bring in buckets of revenue - and that’s a very good thing - as well as take a bit of heat out of the housing market but I just don’t see NG/CGT as the primary driver of the ridiculous rises of the past 25 years.

Look, I appreciate them trying to put primary care on the agenda, but this stuff is so far-fetched, it’ll just be dismissed.

1000 new free clinics? Why not 10,000? This is Homer Simpson for Sanitation Commissioner areas.

Hilly hit the nail on the head - the way you fix housing affordability is

- Allow more high density housing to be approved - yes even in your neighbourhood

- Pitch all the incentives at new builds - no first home buyer grant unless it’s a new build

Home build incentives are dangerous as well though.

WA government gave out heaps to boost the economy after covid and so builders took on way too much work.

There’s people still waiting for houses 3 years down the road.

The only problem is, affordable housing for new developments is usually a small proportion that expires after 10-15 years.

That and developers are in this to make money, not build homes for people.

The only thing new builds do is expand supply, I don’t expect there to be much of a mandate for affordability.

I am confused.

Higher density. No mandate for affordability. But it will fix affordability?

Not sure the math on that one stacks up. Currently in NSW the FHOG is $10K on something under $750K if it’s new.

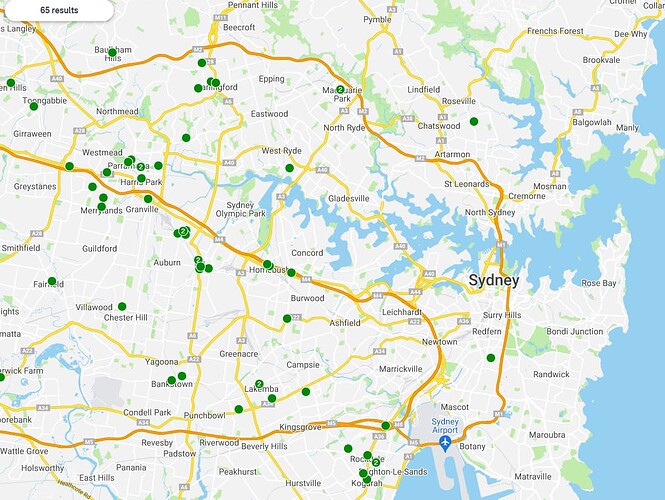

Here is a map of what you can buy that is new in a snapshot of Sydney under $750K (2 bed+)

The current system does not effectively encourage first home owners (especially families) to get into the market in Sydney - the market has surpassed it by far too big a factor.

Affordable housing absolutely needs to be mandated, and not for 10-15 years for the worst apartments in the building like it is with current developments.